My understanding about risk for the longest time was theoretical. Through academia, risk for me was simply volatility of a stock in relation to a benchmark. I would focus on Beta (β) for every stock I researched and overweighed my decision in relation to it. I realized how flawed my thinking was!

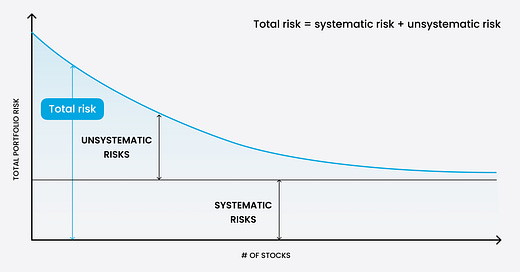

For the benefit of my readers, total investment risk can be divided into two parts, Systematic risk and Unsystematic risk. Unsystematic risk, also known as diversifiable risk is the risk of a particular company or an industry. This risk is idiosyncratic in nature essentially meaning it can be reduced through diversification. Examples include new competition in the market, management change, regulatory shift etc. Systematic risk on the other hand, is the risk associated with the entire economic market. Systematic risks include macroeconomic risk, political risk, currency risk etc. These risks cannot be mitigated through diversification. Managing systematic risk requires inclusion of different asset classes such as fixed income, real estate, and alternative assets which will behave differently when faced with such a risk.

Later, while reading investing literature written by the greatest investors I realized the actual meaning of risk. As Warren Buffet puts it, risk of a stock is the ‘permanent loss of capital’. Such permanent loss of capital situation could occur due to several probable reasons like deteriorating business operations, shady corporate governance practices, default in payments etc. I would not miss this opportunity to mention the recent fiasco of Gensol Engineering Ltd. The company rose to fame in 2022 when it was trading at around Rs.144. It reached a peak of Rs.1280 in Feb, 2024. That is a staggering 9x returns in the span of just two years. However, Gensol experienced precarious fall after irregularities were out in public. The stock nosedived losing more than 90% of its value. Classic case of corporate governance risk at play.

Risk is a loosely used word in the retail investor circles. Rarely people understand the exact meaning of risk. In my limited reading exposure, one investor who has nailed the idea of risk is Howard Marks.

I recently came across his memo named The Indispensability of Risk (link attached at the end), which talks about how necessary is risk taking in investing. The message that hit me the most is that risk is paradoxical. The less risk you take, the more risky it is. But risk alone won’t guarantee success, and that’s the reason it’s called RISK. Risk and return are positively related to each other. We all know the famous line ‘Higher the risk, Higher the return’. But greater risk won’t guarantee higher returns, it could even result in loss of capital. To yield a positive effect of risk and return relationship one should know their risk tolerance.

Risk tolerance essentially means how comfortable an individual is with risk while investing. Risk tolerance varies based on several factors:

i. Time Horizon: Every investor has investment goals. Those investment goals define the time horizon. Some investors practice goal-based investing while some go for longer term wealth creation journey. Ideally, longer the time horizon more risk can be taken.

ii. Age: Age of the investor is a crucial factor to consider for risk tolerance. Younger the investor, higher the risk tolerance. Young individuals have the capability to make more money while working and can deal better with market fluctuations.

iii. Portfolio Size: Another important factor is portfolio size. Larger the portfolio size, more risk tolerance capabilities. An investor having portfolio of over 10 Cr will be more risk tolerant than someone with a portfolio of 10 lakh.

iv. Investor Preference: Investing largely is about mastering your emotional side. Every investor has its own comfort level when it comes to risk. Some are naturally very comfortable with risk taking while some are more risk averse. To each their own!

Knowing yourself, your situation and your style with reference to investing will help you seize right opportunities at the right time and avoid pitfalls along the way. Thought of eliminating risk is an unrealistic aspiration, instead mitigation of risk is where the magic happens.

In conclusion, understanding risk isn’t just about crunching numbers or tracking volatility, it's about understanding yourself. Aligning your investments with your risk tolerance is what separates a good investor from a lucky one.

Disclaimer: The views expressed in this blog are personal and for informational purposes only. They do not constitute investment advice or recommendations. Please consult a qualified financial advisor before making any investment decisions.

Source:

Howard Marks Memo - https://www.oaktreecapital.com/insights/memo/the-indispensability-of-risk

CFI

Safal Niveshak

TradingView

Great Insights!! Keep up the work